These are individuals looking to enter the industry and create start-ups to compete with the existing companies and gain market share. There are no real substitutes available to compete against.Suppliers are concentrated or have a monopoly on supplies.Suppliers retain their power due to the following: A company should not be dependent on one large supplier but have many smaller suppliers in order to decrease supplier power. Suppliers are able to dictate terms of business such as price, quality, delivery times, etc. Similar to buyers, suppliers can also influence industry decision making. This information can place buyers in a better negotiating position. Buyers have complete information on how the industry is working, including demand, actual market prices, and even supplier costs.

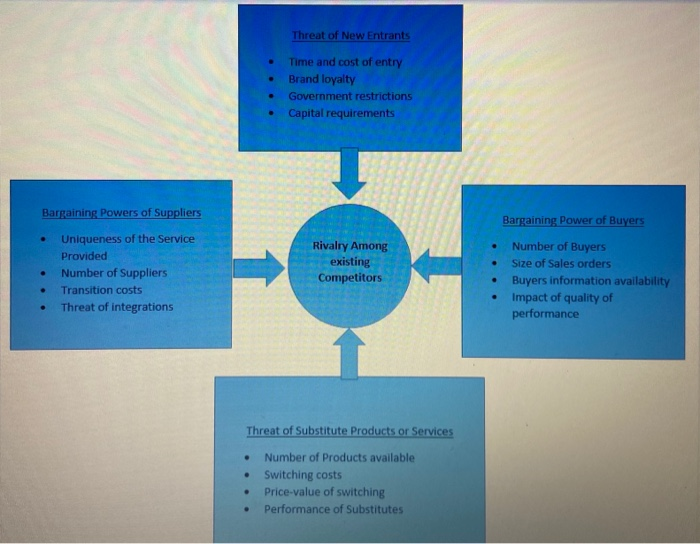

This is due to the undifferentiated and standard nature of the products or services. Buyers are able to switch companies without incurring costs to themselves.A large volume of product is purchased by fewer buyers.Buyers have power if the following occur: However, if the company has few larger buyers, this is not the case. If a company has many smaller buyers, the company is able to lose one such customer without any detrimental effects on the business. Buyers are able to gain all the value for themselves, consequently decreasing profitability for the industry. Buyers with a lot of power can force prices down or demand that the company put more value into a service or product. Figure 1: Porter’s Five Forces (Michaux, 2015)īuyers have the ability to influence the decision-making process of a company. As you can see in Figure 1, four of the forces feed into Industry rivalry. The Five Forces consist of Industry Rivalry, threats of potential entrants, threats of substitutes, strength of buyer power and strength of supplier power. Porter’s 5 forces are therefore used to predict industry trends and changes in competition, and this information can help a company to make strategic decisions about the industry to gain/maintain status within it. It is also able to determine how changes within an industry can affect a given sector. Porter of Harvard Business School in the 1970s, Porter’s Five Forces sets out to answer questions such as: What’s going on out there in your industry? What deserves your attention? Of the many things that are happening, which ones matter for competition? It is able to determine how different parts of an industry interact in order to allow for profitability without changing the level of quality of the product or services provided by industry. These outline 5 forces that drive competition and threaten the company’s ability to make profits.Ĭreated by Michael E. Porter’s Five Forces is a framework used to analyze the balance of power within a particular industry and therefore, its overall profitability.

0 kommentar(er)

0 kommentar(er)